Dahlman Rose Upgrades FRO and OSG

Crude Oil Declines as Reports Show OPEC Production Increase

By Mark Shenk

Nov. 26 (Bloomberg)

Crude oil fell on speculation that OPEC is increasing production to reduce record prices and keep the global economy from slowing.

The 12 members of the Organization of Petroleum Exporting Countries will probably increase output 1.1 percent to 31.6 million barrels a day this month, according to preliminary estimates by PetroLogistics Ltd. OPEC agreed in September to raise production targets for the 10 members with quotas by 1.9 percent starting Nov. 1.

``The Petrologistics numbers are showing a good-size build in OPEC output,'' said Tim Evans, an analyst with Citigroup Global Markets Inc. in New York. ``Most of the increase is from Iraq, which is fairly encouraging.''

Crude oil for January delivery fell 48 cents, or 0.5 percent, to settle at $97.70 a barrel at 2:44 p.m. on the New York Mercantile Exchange. Futures touched $99.11 today, the highest since reaching a record $99.29 on Nov. 21. Oil futures trading began in 1983. Prices are up 65 percent from a year ago.

Iraq, which last month resumed exports from Kirkuk through its northern pipeline network, will make the biggest contribution to the supply increase, raising output by 20 percent to 2.15 million barrels a day, according to PetroLogistics, which assesses supply by tracking tankers.

Iraqi Recovery

``This is the highest we've seen since the U.S. invasion in 2003 and may be a sign that the Iraqi oil industry is finally recovering,'' said Evans.

Iraqi production has yet to recover from the unrest that followed the U.S.-led invasion in March 2003. Iraq produced 2.48 million barrels a day in February 2003, the last month before the invasion. The Persian Gulf country has the world's third-biggest proved oil reserves, according to BP Plc.

Saudi Arabia is producing more than 9 million barrels a day, CNBC reported, citing unidentified people at the Saudi oil ministry. The country, which is OPEC's largest producer and the world's top oil exporter, pumped an average 8.75 million barrels a day in October, the highest since November 2006, a Bloomberg News survey showed.

Prices also fell on signs that slowing economic growth in the U.S., Europe and Japan will curb fuel consumption. Investor optimism about financial markets in the U.S., which consumes a quarter of the world's oil, fell this month to the lowest in two years after concern grew that the country is heading toward a recession, according to a UBS AG poll.

The UBS/Gallup Index of Investor Optimism dropped to 44 in November from 70 last month. The sentiment gauge declined to the lowest level since Hurricane Katrina struck the U.S. Gulf Coast and is down from a three-year high of 103 in January.

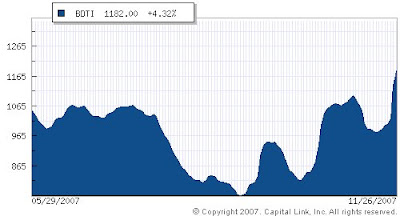

Frontline Ltd., the world's biggest supertanker operator, and Overseas Shipholding Group Inc. had their ratings raised by Dahlman Rose & Co. because of increasing OPEC shipments. Ship- hire rates on tankers sailing to Asia from the Middle East, the world's busiest market for supertankers, more than doubled since Nov. 9, according to data from the London-based Baltic Exchange. Dahlman is an investment bank that specializes in marine transport companies and related industries.

OPEC will load 24.5 million barrels a day onto tankers in the four weeks to Dec. 8, compared with 23.8 million barrels in the month ended Nov. 10, Oil Movements said on Nov. 22. It will be OPEC's 14th consecutive weekly increase and the biggest this year, according to the company, which tracks shipments.

Upcoming Meeting

The group, which produces more than 40 percent of the world's oil, is scheduled to discuss crude-oil production for the first quarter of 2008 at a meeting in Abu Dhabi on Dec. 5.

``We are primed to make another run for $100,'' said Eric Wittenauer, an analyst at A.G. Edwards & Sons Inc. in St. Louis. ``There's a good shot we will make it this time but once that occurs there is no telling what will happen.''

The dollar dropped to a record low against the euro earlier today on concern U.S. credit-market losses may prompt the Federal Reserve to keep reducing interest rates. The U.S. currency recovered against the euro later in the session.

``On one hand there's growing evidence that demand will drop,'' Wittenauer said. ``Economic concerns are being reflected in a number of markets. At the same time, we are seeing weakness in the dollar, which tends to push commodity prices higher.''

No comments:

Post a Comment